Introduction to instant payments

Instant payment systems provide account holders access to instantaneous or effectively instantaneous money transfers between bank accounts. The funds are paid 24/7, 365 days a year, including weekends and holidays, a notable advantage over traditional payments.

More than 70 jurisdictions across all continents have launched instant payment systems. Funds can be transferred through mobile phones, tablets, and websites, secured with multiple-factor authentication.

In the United States, instant payment systems are still in their infancy. There are two instant payment systems in the US:

1. The Clearing House launched RTP in 2017 and has about 456 members.

2. The Fed launched its own FedNow Service in 2023 and has about 360 members.

Both offer very similar pricing. Both systems are not interoperable, so nearly 100 of these financial institutions (FIs) are members of both systems. However, other FIs must ramp up and join both the rails to offer proper instant payments in the US.

The US has about 10,000 financial institutions (FIs). So the adoption rate is between 4-8 % in almost six years. One can imagine the ramp-up time to adopt 70+ instant payment systems around the world for these FIs.

What’s the rush?

Acquisition: According to 451 Research, 45.6% of respondents are likely to open an account with a provider that supports real-time payments. The majority of businesses are looking for FIs that provide instant payment capability. They will take their business to the FI that provides this service. FIs supporting instant payments will stay competitive and grow their client base and revenue. The others will lose out and eventually become irrelevant as they miss out on a valuable market share.

Growth: The FIs that adopt instant payment systems have the potential to achieve some economies of scale. If FIs are able to provide instant payments to other countries, they can scale their business to new markets as never before.

Opportunity: In a current $164 Trillion global market, 80% of businesses expect an increase in cross-border volumes. We are looking at an 8.3% CAGR. This is a significant opportunity and motivation for FIs.

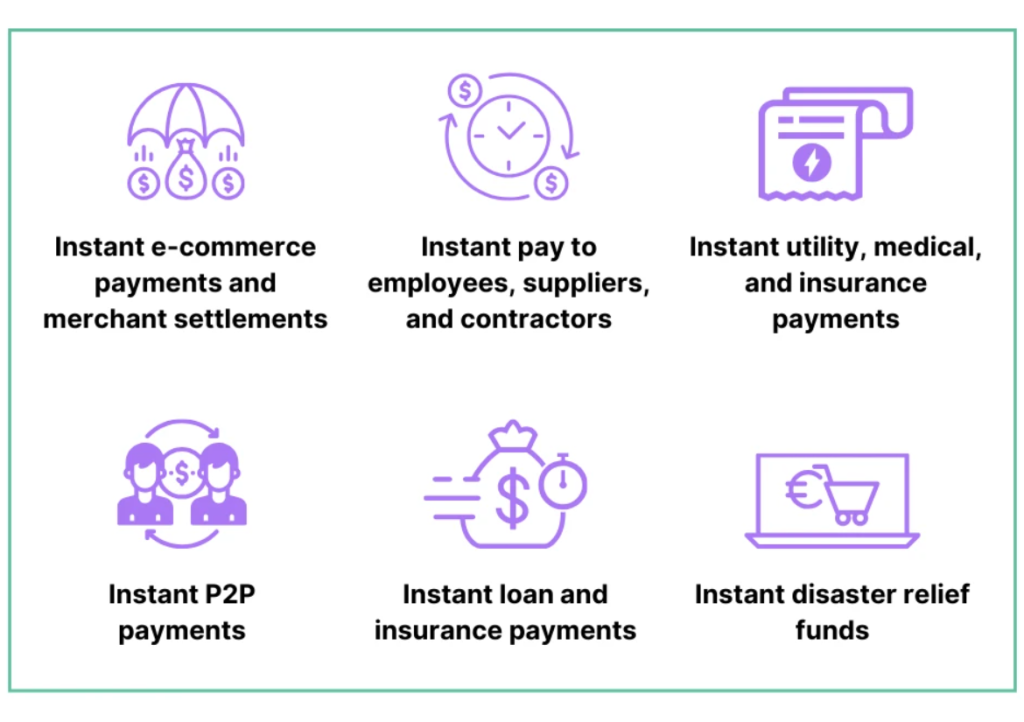

Use cases for instant payments

Why is the market adoption slow?

Looking back into history, the ACH (Automated Clearing House) system was developed by the Federal Reserve Bank of San Francisco and California banks in 1972. The system gradually expanded into a national network in the mid-1990s. Although ACH payments were initially slowly gaining popularity, the volume of transactions grew to 18.5 billion in 2022 after almost 50 years. Interestingly, check payments have also endured despite the rise of digital payment methods.

The adoption of real-time payments is a major undertaking for these reasons and more:

-

Upgrading the existing legacy technology is a significant obstacle. Moving FIs to real-time processing is risky and complex.

-

A substantial investment is needed to upgrade the existing platform. Given budget and technology limitations, about 50% of FIs needed to be sure. Some have yet to see the benefit.

-

Since RTP and FedNow do not interoperate, most FIs will need to implement both over time.

-

Adopting new payment systems is tough, especially when some banks have not prioritized faster payments.

-

Better liquidity management, reconciliation, and error resolution are needed.

-

FI systems need to adopt real-time monitoring and increase their capacity for data processing while reducing their dependence on batch processing.

-

Payments made through these systems are irreversible and may expose users to increased risk of financial loss.

-

Institutions providing instant payments need to effectively mitigate risks, including financial and operational risks, AML/CFT compliance, and robust fraud detection.

-

ISO20022 payment rules, regulations, and data formats are complicated and different.

-

FIs may require assistance understanding the details, risks, and best practices for sending and receiving payments using ISO 20022.

-

For cross-border payments, implementing global compliance checks can be challenging. Operating across different time zones can impose limitations.

-

Training the actual consumers and businesses about its benefits, speed, urgency, irrevocability, and finality, along with the multi-factor authentication setup process.

Conclusion

The lack of instant payment options is expected to cause a loss of customers and market share. Therefore, financial institutions (FIs) must make quick changes to remain competitive, as customer expectations are increasing for fast, secure, and customer-friendly payment systems. This is a significant opportunity for smaller FIs like community banks and credit unions to adopt these systems and remain relevant while providing trusted customers with the benefits of instant payment options.

It is a huge undertaking; hence, FIs should consider partnering with technology service providers to handle technology, integration, and 24×7 customer support. At the same time, they should also focus on improving liquidity management, settlement, and reconciliation with other FIs and robust fraud and risk management. They should consider a phased approach to their roadmap, tackling one use case at a time and one customer segment at a time.

Consumers and businesses are rapidly transitioning to a faster, more efficient digital economy. The market is demanding a better option for payments. So FIs, are you going to say “Yes” to instant payments?

How can Instarails help?

Instarails offers a global solution for payments while minimizing risk and cost through our innovative solution. We connect the current disparate payment systems on our network. We provide FIs with:

-

One API that connects to instant payment systems, mobile wallets, and cash pickup agents worldwide.

-

This integration enables faster payments and empowers FIs to expand into new markets.

-

FIs can make global payments in seconds, 24/7/365.

-

With us, FIs can upgrade, acquire, and grow in the global market opportunity.

Contact us to launch a pilot.

About Instarails

Instarails, an instant global blockchain payment company, aims to make payments instant, inexpensive, and inclusive to all. The team is committed to enhancing the global economy, empowering immigrants from low and middle-income countries, and promoting financial inclusion.

Thin Client Document Scanning applications use only a web-browser so users can easily get work done without any software installation